Description

This wordpress plugin is a lightweight Woocommerce extension.

This plugin adds a VAT field to the billing address at checkout and sets or removes the EU tax rate in accordance with the VAT invoicing rules in the EU.

The Reverse Charge moves the responsibility for the reporting of a VAT transaction from the seller to the buyer of a good or service.

Installation

Copy the unzipped folder to your wp-content/plugins folder or use the WordPress plugin upload-function.

What do you need?

- WordPress

- WooCommerce

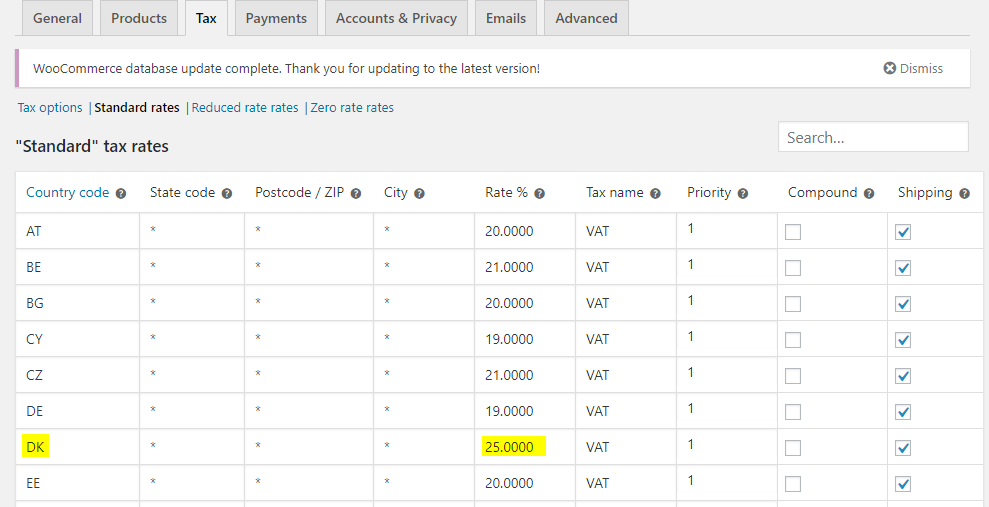

- Tax rates configured for EU countries

What’s included?

- adds a new optional field for VAT to the checkout form

- updates the shopping cart prices when the VAT identification number changes (see limitations & requirements)

- The tax rate is 0% if a VAT identification number has been entered and the country of the customer differs from the country of the shop

- VAT number validation before checkout

- shows the value of the VAT number on the admin order page

- adds an input field for the VAT number in the admin user settings

- shows the value of the VAT Number on ‘My Account’ => Adresses overview

- shows a input field for the VAT number on ‘My Account’ => Edit billing address

Limitations & Requirements

Version 1.0:

This version is tested with WordPress up to 5.2.2 and WooCommerce 3.7.

There are the following limitations:

The update of the price after changing the VAT works only if the official WooCommerce plugin “WooCommerce PayPal Checkout Gateway” is installed, activated and set as an active payment methode.

Don’t ask … . It seems the fields class “update_totals_on_change” is ignored otherwise.

But is doesn’t matter. If the standard PayPal payment methode is active, the “WooCommerce PayPal Checkout Gateway” will be ignored.

Version 1.1:

This version is tested with WordPress up to 5.8 and WooCommerce 5.6.

Ther are no known limitations.

Example Screenshots

Reviews

There are no reviews yet.